We live in challenging times, but when has anything ever been smooth sailing? The financial markets are aware of outstanding issues in the world, and collectively price them in accordingly. That’s why the surprises (both good and bad) have the tendency to result in overshoots of market reaction. For example, despite Tuesday’s “crisis,” markets were already up again Wednesday. In October, the S&P gained 11%, which helped reverse a good bulk of August and September’s losses. Despite the high degree of volatility, however, we are not as far away from late July’s level as it might appear. Read more

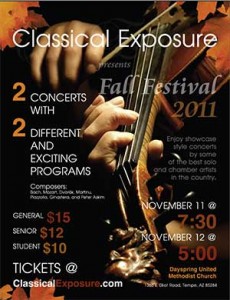

Classical Exposure – Fall Festival

Classical Exposure is presenting its Fall Festival 2011 concerts Friday, November 11 at 7:30pm and Saturday, November 12 at 5:00pm, at Dayspring United Methodist Church at 1365 E Elliot Road in Tempe. With a different program each night, these exciting showcase style recitals feature professional Phoenix area musicians alongside internationally renowned guest artists, playing works by Bach, Mozart, Dvorak, Martinu, Piazzolla, Ginastera, and Askim. Guest artists include Ayane Kozasa, winner of the 2011 International Primrose Viola Competition; Nokuthula Ngwenyama, president of the American Viola Society; and Aaron Hill, oboe faculty at the University of Virginia and principal oboist of the Charlottesville Symphony Orchestra. In its second season,Classical Exposure’s mission is to introduce talented up and coming new artists from around the country, showcase local performers, and provide performance opportunities for exceptional students. Tickets are $15 general admission, $12 for seniors, and $10 for students with ID. For tickets and more information, visit www.classicalexposure.com. Download Program Flyer Fall Festival

Classical Exposure is presenting its Fall Festival 2011 concerts Friday, November 11 at 7:30pm and Saturday, November 12 at 5:00pm, at Dayspring United Methodist Church at 1365 E Elliot Road in Tempe. With a different program each night, these exciting showcase style recitals feature professional Phoenix area musicians alongside internationally renowned guest artists, playing works by Bach, Mozart, Dvorak, Martinu, Piazzolla, Ginastera, and Askim. Guest artists include Ayane Kozasa, winner of the 2011 International Primrose Viola Competition; Nokuthula Ngwenyama, president of the American Viola Society; and Aaron Hill, oboe faculty at the University of Virginia and principal oboist of the Charlottesville Symphony Orchestra. In its second season,Classical Exposure’s mission is to introduce talented up and coming new artists from around the country, showcase local performers, and provide performance opportunities for exceptional students. Tickets are $15 general admission, $12 for seniors, and $10 for students with ID. For tickets and more information, visit www.classicalexposure.com. Download Program Flyer Fall Festival

A Good Week for the Market, Finally

You know what we haven’t talked about lately? Residential real estate. Why is that? Because residential real estate is dead. It has been dead for about 6 years and isn’t getting any livelier. Well, maybe it could be. Let’s explain.

The trouble with residential real estate was that it got far too expensive given its economic utility. We will define its economic utility as the rent it could fetch. When a house cannot be rented out for enough money to carry the mortgage, pay the taxes and yield some small pittance to the investor, it isn’t likely to go up in value. We got to the point where with funny money mortgages, you could get a home for zero down, artificially low monthly payments for the first few years and maybe even interest only for a long time. That made no sense from the lender’s point of view, but they were just going to dump the mortgage on some unsuspecting investor in the guise of a mortgage-backed security anyway, so they didn’t care. Read more

Free 90-minute introduction – Understanding Alzheimer’s Disease and Related Dementias

Banner Alzheimer’s Institute is offering a free 90-minute introduction for caregivers that will give knowledge on disease progression, treatment and practical tips to live successfully. The COMPASS class (Caregivers of Memory-Impaired People Acquiring Successful Strategies) is a free educational class but requires registration. Participants can learn:

• The progression and treatment of Alzheimer’s disease

• Improved communication skills to avoid arguments and behavior upsets

• Tips to enhance everyday living

• Where to begin to find help

WHAT: COMPASS Caregiver’s Class

WHERE: United Methodist Church

Education Building, Room 4

9248 E. Riggs Road, Sun Lakes, AZ 85248

WHEN: Wednesday, October 26, 1:00- 2:30pm

FEE: Free, registration required

RESERVATIONS: (602) 839-6850

Better Late Than Never

With so much to talk about and so little time, we are going to waste this week’s rant by talking about what we shouldn’t talk about. We really have nothing to add on either topic.

First, Occupy Wall Street – a bunch of old hippies, young hippies, unemployed art school graduates and dispossessed liberals decided to demonstrate against Wall Street greed. In the initial phases of this movement, a few of them got maced pretty heavily by New York’s finest for occupying the doorsteps of some of the big bank buildings downtown New York. That was a public relations nightmare for the city and the Bloomberg administration, so they stopped the macing and instead let them set up camp in a city park a little ways away. They let them march around and have their drum circles and the chants so long as they don’t interfere with other people’s right to get to work or go to a dentist appointment. Read more

Autumn Glance at the Dashboard

In light of the market volatility in recent months, we thought it might be a good time to check the gauges in our car and provide a periodic review—a summarized highlight of various asset classes we operate in.

Government Bonds

We might have been considered geniuses if we’d decided that an already-low Treasury yield of 3.0% or so wasn’t already low enough and was poised to hit 1.8%. That was not, in fact, the case. The probabilities were just not stacked in that direction of lower rates, for a number of reasons, and we were not alone in this view at the time. The S&P downgrade of the U.S. government counter intuitively caused a flood of cash away from risk assets into Treasuries, causing them to become even more expensive/lower-yielding. Over the last several years, investments in agency mortgage-backed securities have offered better coupons and valuations, so that is the direction we took—which worked when intermediate-term bonds did well. Read more